Introduction

Even when a sender thinks they have checked and confirmed all the details before making a payment, mistakes can still happen, such as small errors in the amount or payments being sent to the wrong recipient. Reversible payments are essential to deal with such cases.

The Automated Clearing House (ACH) system is an electronic network used to process a variety of financial transactions, including bill payments and direct deposit of paychecks in the US. If there is a problem with an ACH payment, it may be possible to stop or reverse it, unlike wire transfers which are typically not reversible.

What are ACH payments?

An ACH payment is an electronic bank-to-bank payment that is processed through the ACH network in the US rather than using a credit card network like Visa or Mastercard. ACH payments are also called ACH transfers or ACH transactions. Mainly, there are two categories of ACH payments: direct deposits and direct payments.

Direct deposits

These are payments made by businesses or government agencies to consumers, such as payroll, employee expense reimbursements, government benefits, tax refunds, annuities, and interest payments.

Direct payments

These are ACH transactions made by individuals or organisations using their funds. This type of ACH payments is the main focus of this guide. Unless otherwise stated, references to ACH payments, ACH transfers, or ACH transactions in this guide refer to direct payments.

Are ACH payments reversible?

It is generally possible to reverse ACH payments under certain circumstances.

ACH payments take longer to process than wire transfers, typically taking more than three business days to appear in the recipient's bank account. This means that if the sender acts fast enough, the bank may still have time to reverse the payment. It is vital to notify the bank as soon as you notice any unusual payments.

The best time to contact the sender's or recipient's bank is within two days of the posted ACH transaction. If you wait for more than 60 days after receiving your bank statement to report an error in an ACH payment, you may be responsible for any losses to your account, as the bank will not be able to reverse the payment.

ACH reversals are governed by specific rules and regulations. It is important to understand these rules in case your business needs to stop, reverse, or cancel an ACH payment.

Stopping an ACH payment

It is generally possible to revoke authorization for an ACH payment. To do this, the payment sender can contact the recipient (the "biller") and request that they stop the transfer of automatic payments. The sender must also let their bank or credit union know by letter of their request to halt the payment.

If the biller continues to charge the sender's bank account despite the request to stop, it may still be possible to stop the transfer. To do this, the sender should inform their bank at least three business days prior to the ACH payment date and submit the request to stop payment in writing within 14 days.

Stopping an ACH payment may incur a fee, depending on the bank's policies. It is also important to note that asking for a stop-payment with the sender's bank does not cancel their contract with the biller. The sender should still contact the biller to cancel the contract and request that they stop taking payments.

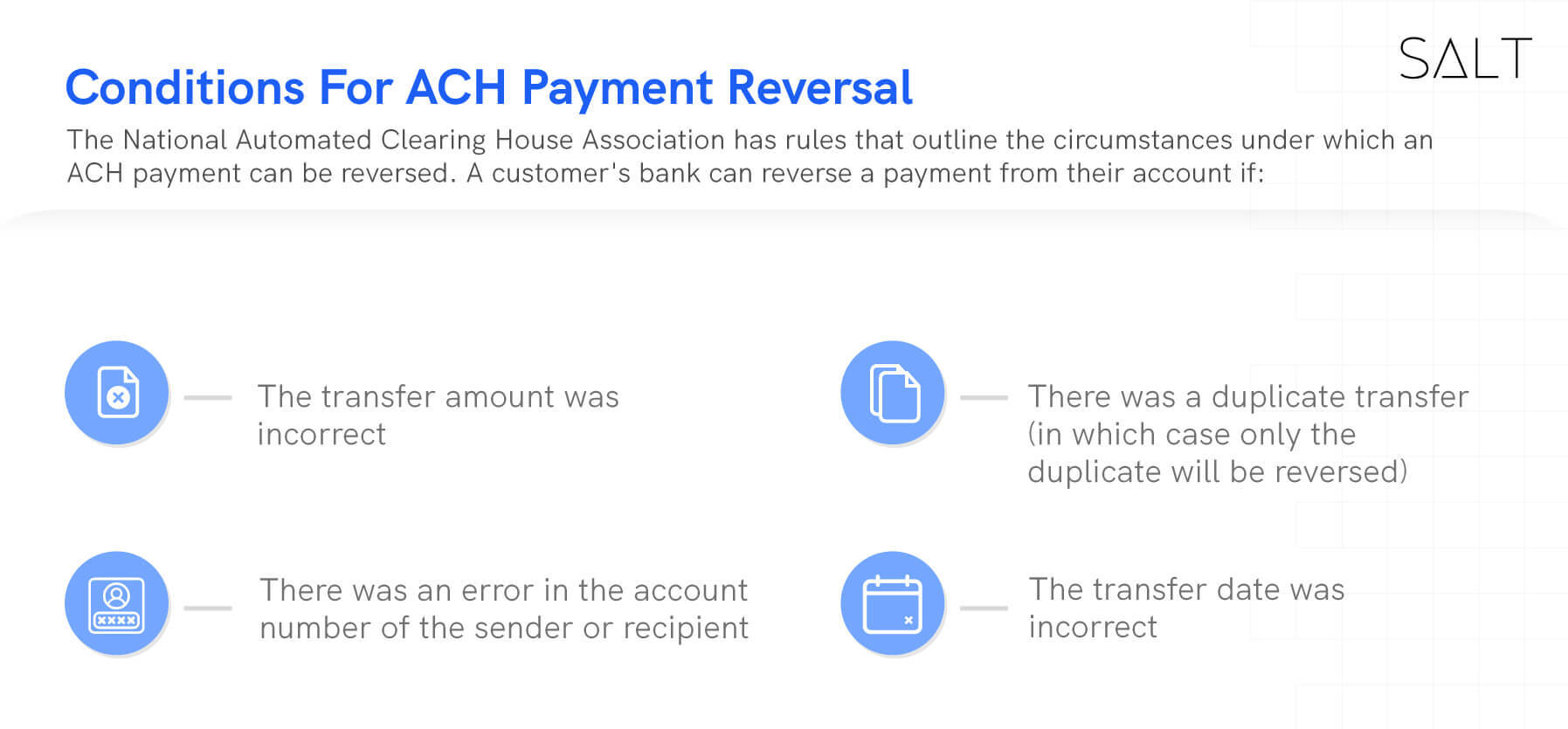

Conditions for ACH payment reversal

The National Automated Clearing House Association has rules that outline the circumstances under which an ACH payment can be reversed. A customer's bank can reverse a payment from their account if:

The transfer amount was incorrect

There was an error in the account number of the sender or recipient

There was a duplicate transfer (in which case only the duplicate will be reversed)

The transfer date was incorrect

If any of these errors occur, the bank must reverse the charges within five days and notify the affected account owners of the reversal. Only the payment sender can submit a request for a reversal, not the recipient (payee or biller).

Rules for the reversal of an ACH payment

Some ACH reversal rules apply specifically to certain industries.

Many businesses use ACH transfers to pay bills, and there may be times when it is necessary to adjust or delay a payment. In these cases, it is important to contact the business or entity initiating the payment, whether that be the biller or the sender's bank.

If the payment is set up to be made each month automatically, the sender should contact the biller to request any changes. If the payment is being made through the sender's bank's online billing system, the sender should contact their bank.

If the sender needs to request a reversal through their bank, they should provide the name of the biller and the payment amount. It is best to make this request at least three business days prior to the scheduled payment date.

Some banks allow customers to alter payments over the phone or online, while others require a written request or the submission of a specific form.

It is important to request any changes as soon as possible, even if the sender has already contacted the biller. The bank should notify both parties of any changes to the payment.

Conclusion

While it is generally easier to reverse an ACH payment than other types of payments, it is important to try to avoid this situation as much as possible. If individuals or businesses request too many ACH payment reversals, their bank may question their reliability in the payment process. Therefore, ACH payment reversals should be used sparingly, only in emergency situations.

We hope that this article has provided you with a comprehensive understanding of ACH payments. If you want to learn much more about the world of finance, we encourage you to check out the Salt blog for additional informative articles.