When did you first start having your salary transferred directly into your account? Have you ever used your bank to make automated payments, such as your mortgage or utility bills, or to pay a vendor without having to write a cheque physically? If you have, you probably know what ACH is all about. Automatic Clearing House (ACH) transfers expedite and protect the transmission of funds between financial institutions and their customers in the US.

The ACH network is a US-specific network of over 10,000 financial organisations.

Contents

Although ACH transfers have gained in popularity, with over 29 billion transactions and over $72 trillion in payments having been expected to be sent in 2021, many companies and consumers still lack an understanding of the intricate workings of ACH.

Through ACH transfers, money is sent instantly and electronically between bank accounts. There is no need for either plastic or cash since money may be transferred directly between banks. This tutorial will walk you through the fundamentals of setting up an ACH transfer, from defining an ACH transfer to outlining what an ACH transaction looks like and how it functions.

What is an ACH Transaction?

An Automated Clearing House (ACH) transfer is a standard method of transferring funds electronically. Direct deposits and online bill payments are only two examples of ACH transactions in your financial life. ACH payments or transfers are various options for moving money between financial institutions.

Direct deposit and automated bill payment are shared ACH transfer uses among the most common electronic bank transactions. ACH transactions are further used in the US for business-to-business (B2B) transactions, direct debit transactions, and M&T (mail and telephone) orders (MOTO). The processing time for an ACH transfer is usually three to four business days. It's also more secure than writing cheques by hand, which increases the risk of identity theft and fraud if the recipient loses the check or someone else gets their hands on it.

How does ACH Transaction work?

Financial institutions in the US use the ACH transaction network to process various transactions, including direct deposit payments, online bill payments, and debit and credit card transactions.

1. A financial institution or other authorised entity must create a batch of transactions to process an ACH transaction. This batch is typically created using specialised software and may include multiple transactions of the same type, such as a batch of payroll direct deposit payments.

2. Once the batch of transactions has been created, it is sent to the ACH operator, a central bank, or another financial institution. The ACH operator then processes the transactions and sends them to the appropriate financial institutions for settlement.

3. During the processing stage, the ACH operator checks each transaction to ensure that it is valid and that the funds are available. If there are any errors or issues with the transactions, they will be rejected and returned to the originating financial institution.

4. Once the transactions have been processed, the funds are transferred between the participating financial institutions. This typically happens within one to two business days, depending on the type of transaction and the financial institutions involved.

Overall, ACH transactions are a convenient and efficient way to process electronic payments. They are secure, cost-effective, and can process various types of transactions. Additionally, ACH transactions can be initiated by the payer or the payee and can be set up to occur on a one-time or recurring basis.

How to make an ACH Transaction

Here's how to make an ACH transaction:

Step 1: Gather the necessary information.

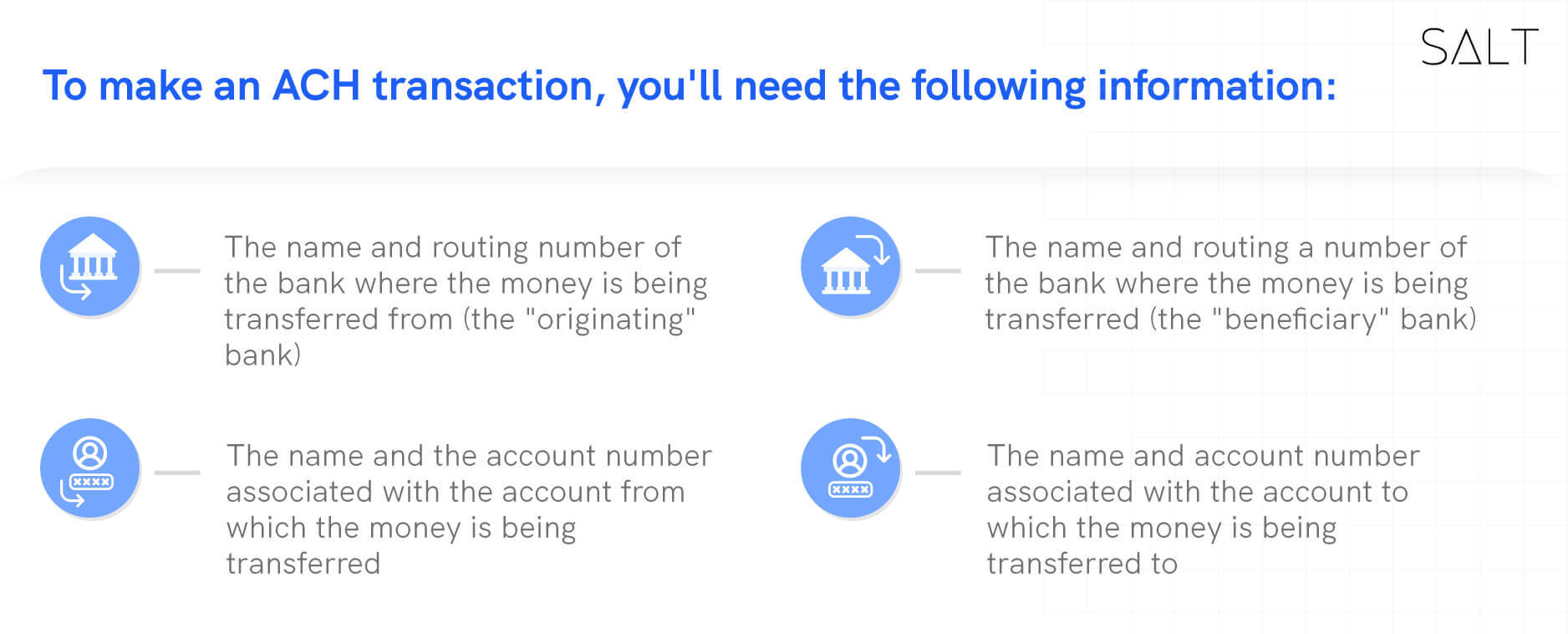

To make an ACH transaction, you'll need the following information:

The name and routing number of the bank where the money is being transferred from (the "originating" bank)

The name and the account number associated with the account from which the money is being transferred

The name and routing a number of the bank where the money is being transferred (the "beneficiary" bank)

The name and account number associated with the account to which the money is being transferred to

Step 2: Contact your bank.

You'll need to contact your bank to initiate an ACH transaction and provide them with the above information. Some banks may allow you to initiate an ACH transaction through their online banking platform, while others may require you to visit a branch or talk with one of their representatives over the phone.

Step 3: Provide the authorisation.

Your bank will need your authorisation to make the ACH transaction. This can typically be done by signing a form or providing written authorisation via email or fax.

Step 4: Wait for the transaction to process.

ACH transactions typically take one to two business days to process. During this time, the money will be transferred from the originating bank to the beneficiary bank.

Step 5: Confirm the transaction.

Once the transaction has been processed, it's a good idea to confirm that the money has been transferred to the correct account. You can check your bank statement or log into your online banking account to view your account activity.

Making an ACH transaction is a simple and convenient way to transfer money electronically between bank accounts. Following the steps outlined above, you can quickly and easily initiate an ACH transaction with your bank.

Another way to make international money transfer is through WIRE transfer. Here's a blog on - how does WIRE transfer works.

Conclusion

In conclusion, making an ACH transaction is a simple and convenient way to process electronic payments in the US. A financial institution or other authorised entity must create a batch of transactions to make an ACH transaction. This batch is then sent to the ACH operator, which processes the transactions and sends them to the appropriate financial institutions for settlement. Once the transactions have been processed, the funds are transferred between the participating financial institutions. ACH transactions are secure, cost-effective, and can be used to process various transactions.

Want to enjoy international banking facilities from the comfort of your home? Visit our website today to find out how!