There are multiple ways to send money, including cheques, apps, and internet banking. When it comes to transferring funds, opting for methods that are speedy, secure and simple to use always remains the top priority. If such factors play an important role in your personal needs, money transfers using wire transfers online may be an appropriate option.

Surely there must be some completely valid and wide range of questions that might be coming to your mind while thinking about wire transfers, such as how does a bank wire transfer work? How do I do a bank wire transfer? How long does it take for a wire transfer? are wire transfers online? Etc. Well, do not worry, for we have got you covered.

In this article, we will deeply explore the topic of wire transfers and cover any questions you may have about them. Let’s explore.

What is a Wire Transfer?

Wire transfers, also termed wire payments are simply transfers of funds that take place online. They are managed by banks and transfer service providers throughout the world. They enable two parties to safely transfer payments even if they are living in different places anywhere around the globe.

An individual making a wire transfer must provide certain information about the recipient, such as their name and account number, as well as information about the institutions that will send and receive the money. Unlike physical currency exchanges, wire transfers are settled electronically rather than physically. One can transfer them between banks or via non-bank services as well. Before being settled, all transfers are routed through a domestic automated clearing house (ACH).

A fun fact for you about wire transfers: In the U.S., The Office of Foreign Assets Control monitors international wire transfers to prevent money from being sent to terrorist organisations or used for money laundering.

How does a wire transfer work?

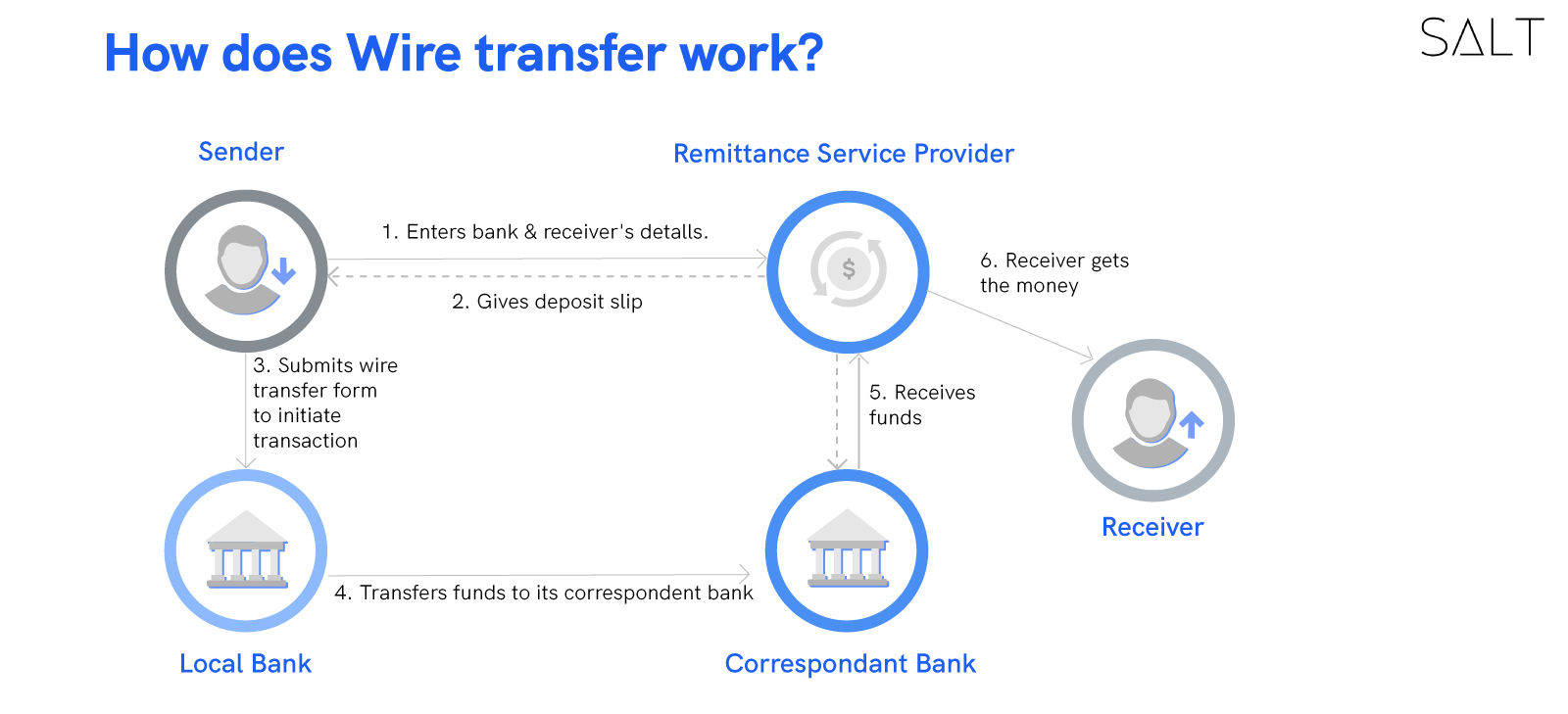

Now let us understand the overall process of exactly how does a bank wire transfer work. Wire transfers are initiated by approaching a banking institution and requesting the transfer of a certain amount of money. For the bank to know where the money should be delivered, the sender provides SWIFT or IBAN codes for the recipient.

A transaction will only be initiated when the sender deposits the funds to be sent and the transaction fee set by the sending bank. The sending bank sends a message to clear the funds using a secure channel such as SWIFT (Society for Worldwide Interbank Financial Telecommunication).

The SWIFT network is the most often used method of wire transfer. It is a communication protocol. In over 200 countries and has a network of more than 11,000 banks. Data is transferred between banks using this network. In addition, it provides instructions on how to make a wire transfer.

A notification instructs the recipient's bank to complete the payment according to the instructions after the funds clear. In some cases, the funds may take many hours or even days to reach the recipient's account from when the transaction was initiated. To settle the payment, both of the banks involved in the process must have a joint account with each other. Otherwise, they can deploy the SWIFT network’s utilities to form a common bridge for value transfer.

This section sums up the overall process of how does a wire transfer work. Hopefully, it has helped you understand and answer the question ‘how do I do a bank wire transfer.’ One thing you should always keep in mind, though, with bank wire transfers, there is certain information that is required to make a successful wire transfer. A word of advice here is just to keep whatever information is needed handy.

Types of Wire Transfers

To understand wire transfers better and how a bank wire transfer works, let us take a look at the two types of wire transfers that are conducted.

#1 Domestic Wire Transfers

A domestic wire transfer is any wire payment between two banks or institutions operating within the same nation. There are two types of domestic transfers: interbank and intrabank transfers. To complete transactions, people sending the funds may be required to present a code or their branch number. These transactions are usually executed on the same day and are generally received within a few hours of being made. ACH (automated clearing house) is needed to send a domestic wire transfer, which can be done within a day of receiving the request.

#2 International Wire Transfers

International wire transfers start in one country and finish in another. Although senders may have an account at the same bank as their recipient from another nation, they are required to conduct international transfers. These payments necessitate the use of a route or SWIFT code. It usually takes two to five business days for wire transfers to be received. A domestic ACH and its foreign equivalent must also clear international wires on the same day.

Advantages and Disadvantages of Wire Transfers

There are a lot of positives when it comes to wire transfers. Bank wire transfers are an easy way of sending money to anyone. International wire transfers generally settle in a couple of days, and domestic wire transfers usually end up being processed on the same day the transactions have been made. As you do wire transfers online, they are more secure and less prone to be lost in the mail than sent checks. Furthermore, they are trustworthy: While checks can bounce, a wire transfer can only be started if the sender has enough money in their account.

However, there are still some disadvantages when it comes to making wire transfers online. Banks frequently impose a fixed cost for wire transactions. This can consume a significant portion of the transmitted sum, especially in smaller transactions. Furthermore, some banks impose a daily limitation on the total number of wire transfers that can be wired.

FAQS

Now let us tackle some general FAQs that can easily pop up in your mind when dealing with wire transfers.

#1 Are wire transfers secure?

Wire transfers are relatively safe and secure, as long as you know who receives them. All parties supposed to be involved in a wire transfer transaction should be obligated to establish their identity if you use a legal wire transfer service, making anonymous transfers impossible.

As mentioned before, The Office of Foreign Assets Control overlooks international wire transfers in the U.S. In India, wire transfers come under the purview of the RBI. Institutions such as these that overlook wire transfers have certain scenarios in place that need to be on the lookout for throughout the monitoring process. Some of these scenarios can be any of the following:-

Transfers to safe-haven nations

Account transfers to people who do not hold an account

Transfers regularly for no discernible cause

Sending and receiving wires transfers online of the same monetary value

Cash firms wire large sums

Overall, wire transfers online are secure, but there are always risks to everything. So at the end of the day, it falls to you and your decision to opt for wire transfers or not, all the while doing the necessary research.

#2 What are the risks of wire transfers?

While wire transfers are one of the safest modes to transfer value, risk factors exist for everything. One of the major risks that come with wire transfers online is when scammers gain control of another person's bank account and make withdrawals or re-route assets to some other account. Account holders may be unable to reclaim their funds in such circumstances should they report the incidents early before the scammers carry out their plans. Also, it is difficult to reverse a wire transfer in the case of changed circumstances or wrong transfers.

#3 How long does it take for a wire transfer to be complete?

Answer: Domestic bank wire transfers can take anywhere from one day to even three days, but they are usually much faster, particularly if the sender and receiver of wire transfers are using the same banking institution to complete this transaction. International wire transfers might take approximately five business days to process and come through completely. However, a wide range of factors can affect the overall period of wire transfers. Factors like bank holidays and other circumstances may create hindrances and delays of up to three weeks.

#4 When should wire transfers be used?

Answer: Wire transfers are widely used for domestic and international transactions in the United States. They are ideal for international transactions since they can easily convert to another currency if necessary. Other variables include the requirement to finish a transfer quickly or shift huge sums of money. Most domestic transfers are done on the same day, and international transfers are usually processed quickly (the time period depends on the country). Though restrictions vary depending on the payment processing operator, they are typically substantial. As a result, wire transfers are frequently used to pay bills, send money to family members, or complete real estate transactions.

How does Salt help with international payments?

With its user-friendly interface and fast, secure borderless transactions, SALT is an optimal solution for international payments and making wire transfers online. SALT, offers international payments and compliances services to startups, SMEs, freelancers, all without any hidden fee or additional fees or markups.