Small and Mid-sized Enterprises (SMEs) represent about 95-98% of the total industrial enterprises around the world. However, these businesses frequently lack access to critical financial services and risk-mitigation strategies when it comes to international trades. Small, medium and large businesses indulging in international trade require to transact with their global clients and send and receive international payments. An international business payment is any payment made by a company to a person or organisation located outside of the country.

Contents

SWIFT, RDA, and MTSS (Money Transfer Service Scheme) make it simple to transfer money anywhere in the world. Such money transfers are typically governed by the central banks of various countries. Every country has its own set of rules and regulations in place to govern financial markets and foreign remittances. In India, remittances are governed by the Reserve Bank of India (RBI) and the Foreign Exchange Management Act (FEMA).

In India, for any remittance, you need to provide the purpose of such remittance for it to be successful. From education to business, the purpose of remittance can be many. Therefore, to avoid any confusion and for the smooth processing of the system, RBI has issued a list of purpose codes to be used during any kind of foreign transaction. But what exactly is a purpose code? Let's have a look.

Watch this Youtube video on What is Purpose code in international transactions.

What is the Purpose Code?

A purpose code is a code issued by a country's central bank that is required for successful cross-border transactions. The code is assigned to each transaction involving foreign currency and states the purpose for which the transaction is being made. Purpose codes from both the sender and receiver countries may be required when making a cross-border payment in order to meet the regulatory requirements of the banks issuing the codes. In India, the purpose codes issued by the RBI are of two categories:

Payments received by Indians or for inward remittances in foreign currency

Payments sent by Indians or for outward remittance in foreign currency

In other words, the purpose code assists regulators in determining the precise nature of a cross-border transaction. For example, if the purpose of your foreign transaction is 'purchases for travel,' you must use the code P0301 when processing the transfer. If you use a payment system like PayPal to receive payments in foreign currency, you must select the correct purpose code before you can withdraw funds from your PayPal account to your local Indian bank account. You only need to enter the purpose code once, and it will be used as the default reason for all future payments. To accept international payments in India, you will also need a Foreign Inward Remittance Certificate (FIRC) along with the correct purpose code.

The RBI has a specified list of Purpose codes that are required to be included in the details for every remittance so as to specify the nature of the transaction and the individual reason for which the transfer is being made. These codes allow the RBI to classify remittances. No wonder, purpose codes are essential in India, given that India is the largest receiver of inward remittances globally. One needs to keep one’s finances sorted!

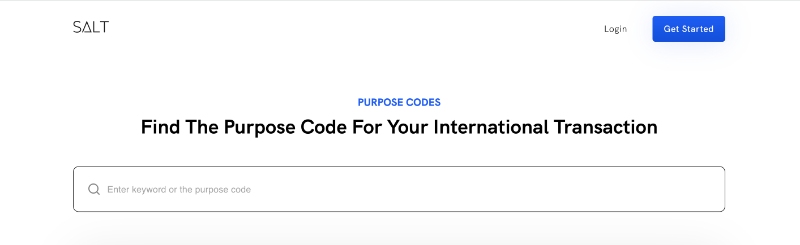

Find Out The Purpose Code For International Transactions

We have created a tool that helps businesses to find out the purpose code that is required to be filled when you are initiating an international transaction. You can simply find the related purpose code by writing the related keyword. Find out the purpose code.

Countries Mandating Purpose Codes for Cross-Border Payments

Cross-border payments are not something new. In 2021 the amount of B2B cross-border payments around the world was a whopping $143.5 trillion. And with the increasing amount of cross-border transactions, it is important for financial institutions to keep track of the inward and outward remittances. India is not the only country mandating purpose codes to execute cross-border transactions successfully. Countries like Bahrain, China, Malaysia, and the United Arab Emirates have issued purpose codes through their central banking authorities for regular cross-border transactions. However, one of the major issues in today's cross-border payment system is its high fees. But worry no more, as SALT has already taken major steps to resolve the issue.

How Does SALT Help in Cross Border Payments?

SALT is a neobank that is making cross-border payments easy for businesses.

With SALT, you can transfer money from abroad within 24 hours at a charge of just 1.75% of the total transaction amount. Whether you are a startup or an SME, SALT requires no minimum transaction amount to use its services. There are no hidden charges, no annual subscription fees, and no markup fees for using SALT.

Therefore, with SALT, any freelancer, any startup, SME, or even large company - everyone can perform cross-border payments with ease.