What is a Foreign Inward Remittance Certificate?

Foreign Inward Remittance Certificate (FIRC) is a document that serves as proof of transfer of inward remittance to India. The certificate has to be acquired by beneficiaries who receive international payments made to India. Most statutory authorities consider it to be documentary proof proving the legitimacy of the foreign funds received by the beneficiary.

The regulatory framework concerning FIRC and its issuance is governed majorly by two bodies; namely:

- Reserve Bank of India (RBI)

- Foreign Exchange Dealers Association of India (FEDAI)

When beneficiaries accept an international payment from outside India, only an authorized dealer (AD) may credit it to the beneficiary’s account (normally a Bank).

According to the Foreign Exchange Management Act (FEMA), an authorized dealer is a person/entity who has been granted permission by the Reserve Bank of India to transact in foreign currency or foreign securities.

The inward remittance is transferred to the recipient's account through an authorized dealer if the bank where the beneficiary has his account is not an AD itself. The AD banker will issue FIRC specifying the purpose of receipt, such as towards equity investment, advance against export of services or goods, capital expenditure, etc., based on the information provided by the recipient upon receipt of money.

All this information may sound overwhelming, but let's take it slow and understand it in more detail.

Who issues FIRC?

FIRCs can only be granted by Authorized Dealer Category I (AD) banks in India, according to RBI and FEDAI (Foreign Exchange Dealers Association of India) regulations.

Who needs FIRC?

A FIRC is needed by the Indian vendors or service providers who receive international payments.

Here are some such scenarios in which it might be required:

- A salaried employee who is paid in a foreign currency.

- A freelancer who accepts international payments.

- Customers buying in foreign currency from an e-commerce store

- A startup receiving inward remittance from a foreign investor

- An export/import business that accepts international payment from its foreign clients

- Individuals sending money to their relatives in India

- Charity donations to India from overseas

FIRC is given a lot of weightage as far as inward remittances from outside India are concerned. Therefore, beneficiaries must follow up with the banks and get the FIRC once the inward remittance has been credited. Close attention must be paid to the "purpose of remittance" because any incorrect mention of this can negatively affect how money is sent, used, and recorded.

Now the question arises, how to get FIRC? Let us find out.

How to get FIRC?

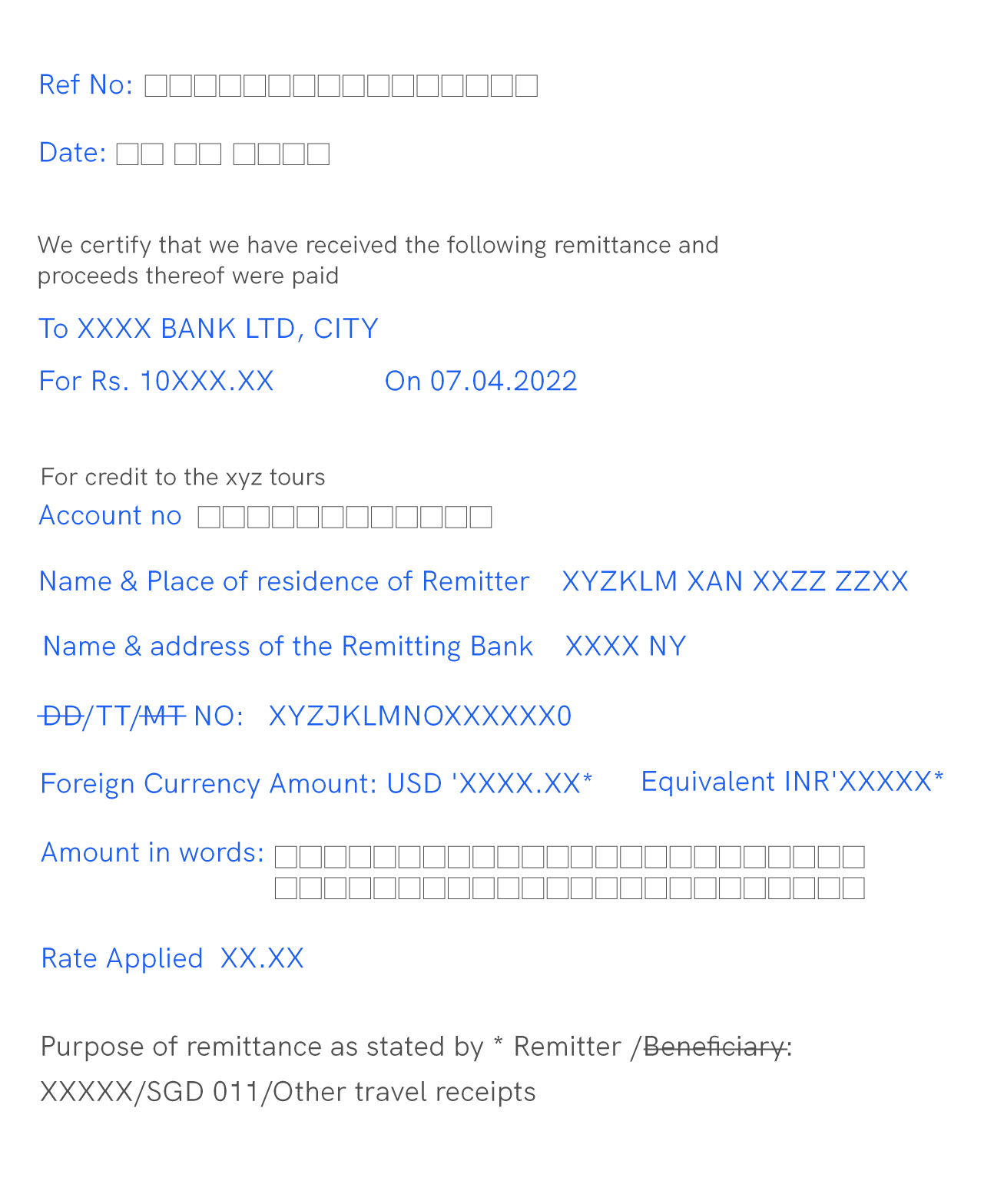

What is the FIRC request letter/ FIRC Certificate format?

Your beneficiary must write a letter or send an email to their bank to request a FIRC. The following information should be included in the letter or email:

Beneficiary Information

Unique Transaction Reference number (UTR): The Transaction ID or UTR is a unique number assigned to each transaction.

Customer name

Account number

Amount of remittance: Payment information, such as the amount realized in foreign currency and the equivalent in Indian rupees

Date and purpose of the payment (purpose of payment to match with the purpose shared at the time of remittance)

The postal address you want the advice to be delivered to; The postal code identifies the cross-border transaction's nature. The information provided above will aid in determining the source and destination of cash.

It's critical, to be honest about the reason for the remittance. This is because banks typically want verification of the stated purpose.

What distinguishes the FIRC from the BRC?

The distinction between the FIRC (Foreign Inward Remittance Certificate) and the BRC (Bank Realisation Certificate) is frequently unclear and can cause confusion for many people. So let's get on to the difference between the two.

Customers who receive an international payment from abroad are issued BRC and Foreign Inward Remittance certificates by the beneficiary's AD (Authorized Dealer) institutions.

However, the following distinguishes them:

- The bank issues a Foreign Inward Remittance Certificate in connection with receiving international payments from abroad. Now, this sum can be compensation for exports or an advance payment for air or ocean freight. It could even be compensation for consulting services.

- The Bank Realization Certificate is issued expressly in connection with the export of goods by the beneficiary's bank. The bank issues the BRC for each shipment of export revenues.

- Consider that you are an exporter. You probably wish to use the financial aid or import duty exemptions that the government or a government agency offers. To collect such advantages, you must confirm your exports to these organizations. BRC helps you qualify for such exemptions and serves as evidence of your export-related activity.

The Bottom Line

The FIRC is also quite important regarding inward remittances, as was already mentioned. Therefore, when the inward remittance has been credited, it is crucial and imperative for the beneficiaries to follow up with the banks and get their FIRC issued as soon as feasible.

Salt provides FIRC to its users for inward remittance transactions. Sign up today to accept foreign money to India in 6 currencies within 24 hours!