In today's interconnected world, cross-border transfers play a crucial role in the success of many businesses. However, dealing with payment platforms with excessive fees, hidden charges, and the risk of blocked accounts can be frustrating and detrimental to your business. That's where Salt comes in as a reliable alternative to platforms like Payoneer.

With Salt Fintech, you can experience hassle-free international payments, transparent pricing, and exceptional customer support. Let's compare Salt and Payoneer to see why switching to Salt could be a game-changer for your cross-border business.

What is Payoneer?

Payoneer is a leading global payment platform that provides businesses and freelancers with a seamless way to send and receive international payments. With Payoneer, users can create virtual bank accounts in multiple currencies, allowing them to transact internationally easily. The platform offers various services, including payment processing, currency conversion, and compliance solutions.

However, Payoneer has been known to charge excessive fees and offer little support when it comes to their customer services, among other cons. Here’s where Salt Fintech can help you out!

Salt Or Payoneer? : A Comparison

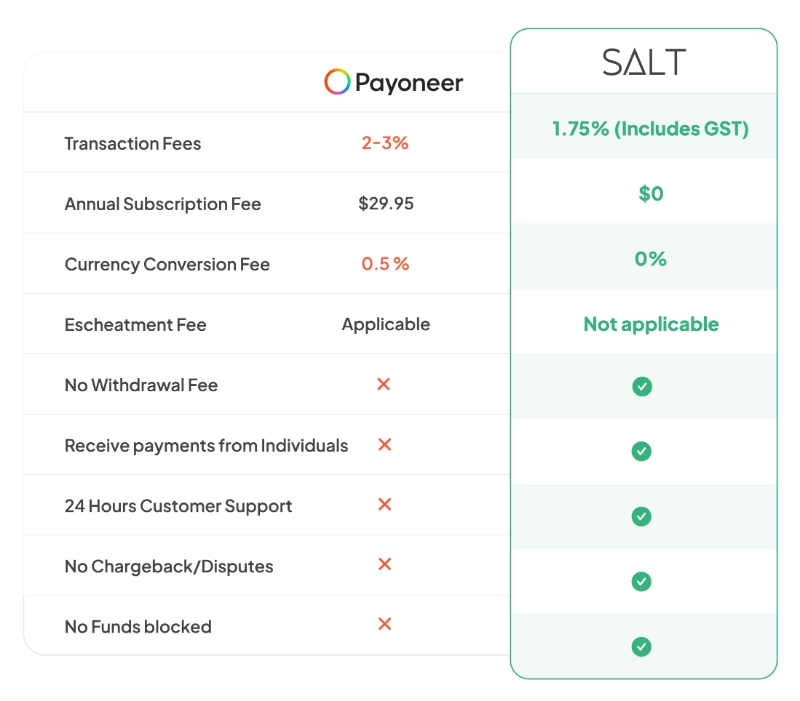

Let’s compare Salt Fintech and compare to see how Salt improves upon the cons of Payoneer:

Transaction Fees and Annual Subscription

Salt takes the lead in transaction fees by offering a competitive rate of just 1.75% (including GST), whereas Payoneer charges 2-3%. This seemingly small difference in fees can significantly impact your bottom line, especially for businesses that engage in frequent cross-border transfers.

By choosing Salt, you can save money on transaction costs and allocate more resources towards growing your business.

Furthermore, Payoneer charges an annual subscription fee of $29.95, which can add up over time. In contrast, Salt doesn't impose annual subscription fees, providing a cost-effective solution for businesses of all sizes. By eliminating this additional expense, Salt Fintech allows you to retain more of your hard-earned profits.

Currency Conversion Fee

Another area where Salt shines is in currency conversion fees. While Payoneer charges a 0.5% fee for currency conversion, Salt offers a 0% currency conversion fee. This means that when you receive payments in different currencies and need to convert them, Salt ensures you don't lose a significant portion of your funds to conversion charges.

With Salt, you can convert your earnings without worrying about additional fees, maximising your earnings and reinvesting them into your business.

Escheatment Fee and Withdrawal Fee

Salt stands out from Payoneer by not charging any escheatment fees. Escheatment fees are imposed when an account becomes dormant or inactive, and the funds are turned over to the government. With Salt Fintech, you don't have to worry about losing your funds due to inactivity. This provides peace of mind, especially for businesses that may experience fluctuations in transaction volumes.

Additionally, Salt eliminates withdrawal fees, whereas Payoneer charges fees for withdrawing funds to your local bank account. This added benefit ensures that you have easy access to your money without incurring unnecessary charges. It helps you efficiently manage your finances, ensuring your cash flow remains uninterrupted, and your funds are readily available for business operations.

Receive Payments from Individuals and Merchants

One key advantage of Salt is its ability to receive payments from individuals and merchants. Payoneer, on the other hand, restricts receiving payments from individuals. This flexibility opens up more opportunities for businesses that cater to a diverse range of clients. Whether you're a freelancer collaborating with individual clients or an e-commerce seller receiving payments from customers worldwide, Salt accommodates your needs and enables seamless transfers with individuals and merchants.

Best Possible Foreign Exchange Rate

Salt understands the importance of favourable foreign exchange rates for businesses operating globally. Salt follows the live exchange rates on Google to ensure that your business gets the most out of every dollar you earn. Using real-time exchange rates, Salt ensures you receive competitive rates for currency conversions. This transparency and commitment to providing the best possible exchange rates translate into cost savings and increased profitability for your business.

No Risk of Random Blocked Accounts or Chargebacks

One of the most significant concerns when using payment platforms is the risk of random account suspensions or chargebacks. These situations can disrupt your business operations, cause financial losses, and erode trust with clients or customers. Salt addresses this issue by boasting a spotless record with zero cases of random account suspensions on international transactions. With Salt, you can operate your business with peace of mind, knowing that your cross-border transfers are secure and reliable. This reliability fosters trust with your partners, clients, and customers, enabling smoother business relationships.

24-Hour Customer Support and Relationship Manager

Salt goes the extra mile by offering 24-hour customer support, ensuring you can reach out for assistance whenever needed. Whether you have a question, need clarification, or require technical support, the Salt customer support team is readily available to provide guidance and resolve any issues promptly. This commitment to customer service sets Salt apart from Payoneer, offering you peace of mind and the assurance that your concerns will be addressed promptly.

Additionally, Salt provides support from a dedicated relationship manager. This personal touch adds value to your experience, as the relationship manager is your point of contact for any queries or concerns. We can provide tailored assistance based on your business requirements, offering expert insights and guidance to optimise cross-border transfers. This personalised support establishes a strong partnership between your business and Salt, ensuring you receive the attention and assistance you need to thrive.

Salt: The Premium Business Choice for Cross Border Payments

When it comes to international payments, Salt emerges as a strong contender against platforms like Payoneer. With its lower transaction fees, absence of annual/withdrawal/conversion/escheatment fees, ability to receive payments from individuals and merchants, competitive exchange rates, and stellar customer support, Salt offers an appealing alternative for businesses seeking a reliable cross-border payment solution.

By switching to Salt, you can bid farewell to random blocked accounts, chargebacks, and excessive charges, allowing you to focus on what matters most: growing your business and forging international connections with ease.

Make the smart choice and consider Salt as your trusted partner for hassle-free and cost-effective international payments. With Salt, your cross-border business can thrive in a secure and supportive payment ecosystem!

Another Payoneer alternative is PayPal for cross-border business transactions. Read this blog to compare Salt with PayPal in detail!

Frequently Asked Questions (FAQs)

1. Is Salt a suitable alternative to Payoneer for cross-border payments?

Salt offers hassle-free international payments, lower transaction fees, and the ability to receive payments from individuals and merchants, making it a great alternative to Payoneer.

2. Does Salt charge any annual subscription fees?

No, Salt does not charge any annual subscription fees, allowing you to save on additional costs associated with your cross-border transactions.

3. How does Salt ensure the best foreign exchange rates?

Salt follows live Google exchange rates, ensuring you receive competitive currency conversion rates and maximising your earnings.