SALT is the one stop solution for receiving global payments

India stands as the world's largest recipient of foreign remittances, thanks to the growing business environment throughout the country. It received $87 billion in 2021 in remittances. The United States was the largest source of these inward remittances, accounting for more than 20% of these funds.

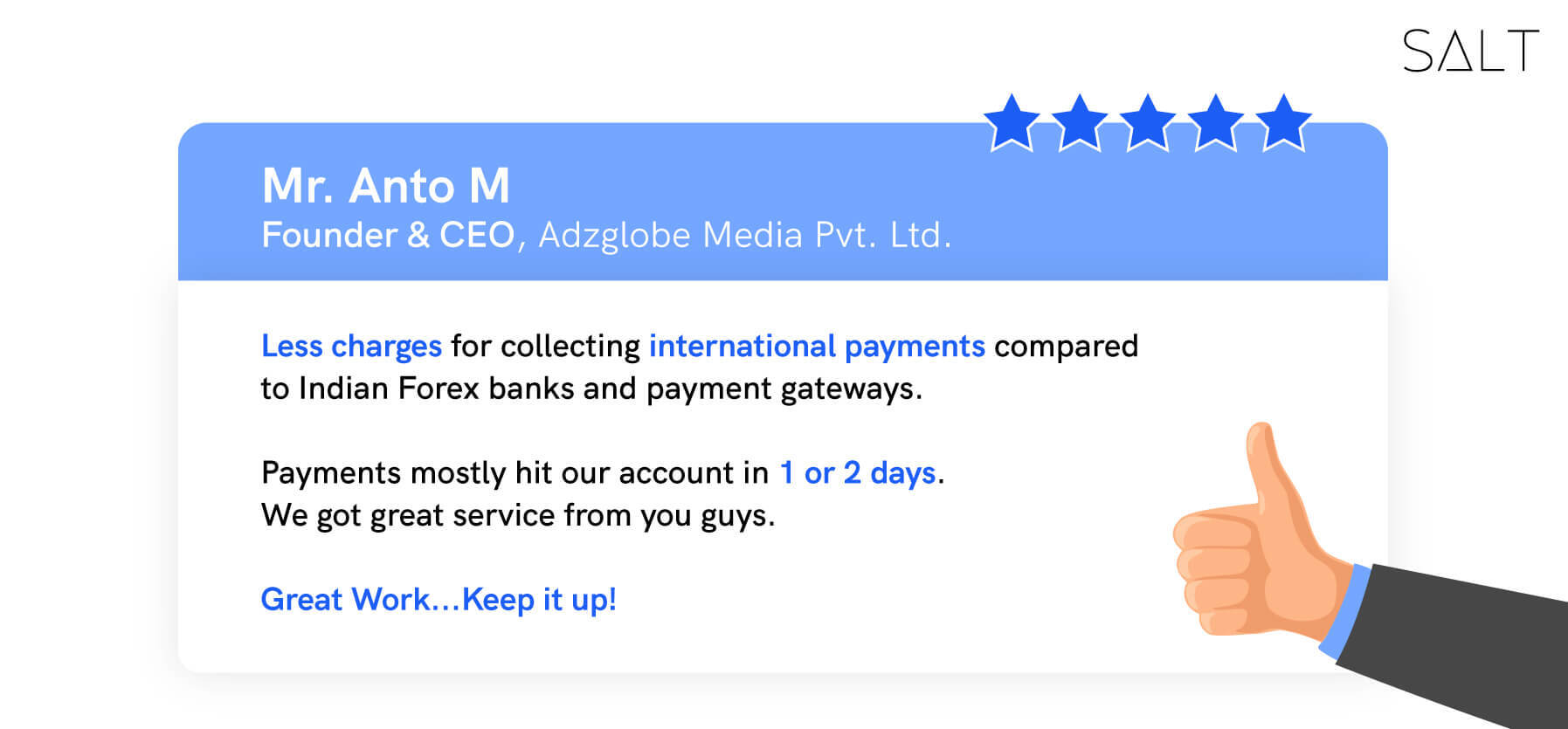

Receiving global payments, on the other hand, can be quite expensive. A remittance transaction's costs include a fee charged by the sending agent. This is typically paid by the sender. Further, there is a currency conversion fee for delivering local currency to the beneficiary in another country. However, to make it easier for small businesses and SMEs to seamlessly receive global payments, SALT came into action.

Contents

What is the SALT Startup?

SALT is a digital-only cross-border payment experience for SMEs. We assist in providing banking, documentation management, and workflow automation solutions to small-size exporters and importers who are actively dealing with international transactions.

What does SALT do as a Fintech Startup?

SALT is a neobank that strives to make cross-border payments as simple as possible for businesses. SALT enables you to send money from abroad within a day for a low fee of 1.75% of the total transaction amount. In addition, unlike traditional financial institutions, the SALT verification process is straightforward and quick. Simply register for SALT and fill out the required information from the comfort of your own home.

Domestic transactions have become much more smooth and simple thanks to UPI. However, international transactions remain complex and are scrutinised more closely by government agencies. Especially if it is a business transaction. There are many legal documents involved in addition to the banking process. We intend to handle not only banking but also the associated documentation. By 2025, we aim to make international transactions as simple as UPI payments.

Who are the founders of SALT?

SALT was founded in 2020 by Udita Pal and Ankit Parasher.

Udita received her bachelor's degree in mass communication in 2017. As a team member of Opentalk, Tapchief (acquired by Unacademy), and Manch, Udita has worked in product growth, marketing, and brand. She has also served as a consultant to over 35 startups worldwide, assisting them in scaling from 0 to 1.

Ankit graduated from IIT Kharagpur with a bachelor's degree in electronics engineering. Then he went on to earn a bachelor's degree in law. LetsTransport was previously co-founded by him. This technological logistics platform has previously raised over $35 million with Ankit's contribution. He has been named one of Forbes Asia and India's 30 under 30.

Curious to know why we named the startup 'Salt'? Here's a blog on why do we call SALT 'Salt'.

Who Uses SALT FinTech?

As mentioned earlier, SALT is made to make cross-border payments easier than ever before. SALT does not have a minimum transaction amount. Therefore, if you are a startup, an LLP, a private limited company, or a SME, using SALT is convenient for all. When you use SALT, there are no hidden fees, annual subscription fees, or markup fees. As a result, with us, any business, even a large corporation, can easily perform global cross-border payments.

How is SALT helpful for Businesses?

We currently have two products on the market. Our flagship product, 'Inward Remittance,' allows small businesses to remit funds by opening virtual accounts in the UK and the US. By partnering with banks and financial services in 50+ countries and six currencies, we enable businesses to set up virtual foreign currency accounts. On each transaction, businesses are charged a flat percentage. We have completed $10 million in transactions between March and May 2022, with 300+ clients on board. Every transaction on SALT is safe and compliant because we work with banks regulated by the RBI and respective regulators in each country. These regulated partners hold and manage transactions.

'Table by SALT,' the second product, is still in beta. It is a tool that assists early-stage startup founders in raising funds from foreign investors by automating fundraising, banking, and compliance tasks. SALT allows you to fill out and submit RBI and MCA filings, open a capital account, create a valuation report, and receive foreign investments in a matter of seconds. Businesses can use Table by SALT to manage pre-funding compliance. These include the management of notice, board resolution, and shareholding agreement, among other things. Manage post-funding compliance for foreign investments under the RBI, MCA, and FEMA, and expedite FCGPRS, FCTRS, and other filings.

Conclusion

We do hope this post has helped you understand Salt as a fintech and our functions better. Interested in learning more about our products? Give our website a visit today!