Acquiring BRC from the DGFT

As an exporter, you know that receiving payment for your goods or services is just the beginning of a successful transaction. To fully realise the benefits of your exports, you must obtain a BRC from DGFT (Directorate General of Foreign Trade). What is the BRC full form? Why, a Bank Realisation Certificate, of course.

The BRC proves that you have received payment and opens up opportunities for claiming benefits under the Foreign Trade Policy (FTP) and the repatriation of export proceeds.

In this post, learn how to get the Bank Realisation Certificate from the DGFT so that you can take your export business to new heights! But first, let's see what BRC is, before we get into BRC details you must be aware of.

What is BRC?

BRC stands for Bank Realisation Certificate. It is a document issued by a bank that certifies that an exporter has received payment for goods or services exported. The BRC serves as proof of payment received by the exporter and is required by the Directorate General of Foreign Trade (DGFT) for various purposes, such as verifying your claim of benefits under the Foreign Trade Policy (FTP) and for repatriation of export proceeds. The BRC is an essential document for exporters, enabling them to access various government incentives and benefits and ensure compliance with foreign exchange regulations.

BRC Details: How To Get BRC From DGFT?

The DGFT didn't automate the procedure for getting a Bank Realisation Certificate until 2012, when they launched the eBRC platform. Before that, to acquire a BRC, the exporter had to visit their bank physically. The exporter subsequently sent the BRC to the appropriate regional DGFT office. The DGFT application was manually updated with the BRC information. It was cumbersome and time-consuming to apply for export incentives because of this. Due to the eBRC, the exporter no longer has to physically visit the bank or DGFT authority.

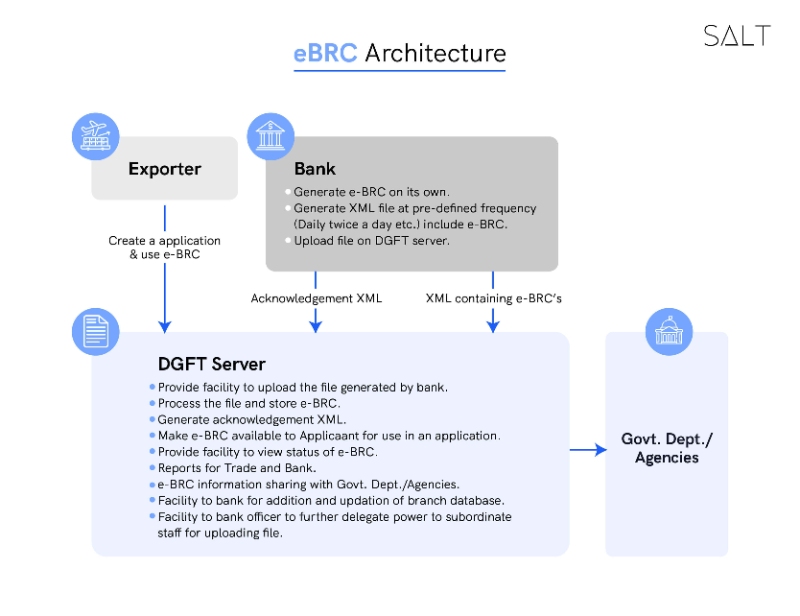

BRC Details: How Does the eBRC System Function?

Here is how the procedure of acquiring eBRC works:

When you as an exporter receive your shipping bill payment in your bank account, you need to submit the eFIRC or Electronic Foreign Inward Remittance Certificate and export documents with the respective bank.

When the bank receives money from exports, it creates an electronic BRC.

Then, it generates an XML file describing the eBRC in digital format.

The bank digitally signs the XML document.

The subsequent step is for the bank to send the XML file to the DGFT server. This is done by going to the DGFT website, signing into the e-BRC application, and selecting "Upload eBRC."

The DGFT server checks the user's credentials and the submitted file for accuracy. After the file has been successfully uploaded, an acknowledgement is sent to the bank.

You can see the eBRC’s status on the DGFT website, and print it to claim export incentives.

BRC Details: How to Check for eBRC on the DGFT Website?

Log in to the DGFT website.

In your dashboard, you should see the ‘Repositories’ option.

Through that, you will find the ‘Explore’ option under the ‘Bills Repositories’ tab.

Choose eBRC from the drop down menu of ‘Select Bill’.

Enter the correct timeline for yourself, and use the search function.

All eBRCs uploaded by the banks where you hold your accounts will be shown on the screen.

BRC Details: The significance of a Bank Realisation Certificate (BRC)

The Directorate General of International Trade (DGFT) looks to automate and systematise the recording of international trade and transactions through the BRC.

BRC verifies that an exporter has been paid for goods or services exported abroad.

BRC is a crucial resource for economic data and financial statistics.

Any company seeking advantages under the Foreign Trade Policy must provide proof of payment for exports, which is where BRC comes into play.

Bank Realisation Certificates are a streamlined form of export documentation.

BRC Details: Conclusion

To fully take advantage of your exports, obtaining a Bank Realisation Certificate (BRC) from the Directorate General of Foreign Trade (DGFT) is essential. The eBRC system has simplified the procedure by allowing banks to generate electronic BRCs and send them directly to the DGFT. This in turn makes it easier for exporters like you to claim benefits under the Foreign Trade Policy and repatriate export proceeds.

We do hope this post helps you learn about the crucial BRC details you’d need as a small business exporting goods!

At SALT, our goal is to make global banking easy for small businesses like you, so you can conveniently manage your finances with local accounts! Check out our website now to learn more about us!