Foreign Inward Remittance Certificate (FIRC) is a document issued by banks in India as legal proof of inward remittance of foreign currency to Indian accounts. FIRC is crucial to claim GST refunds, as it helps authenticate the inward remittance received from an overseas party.

In this article, we will discuss the importance of FIRC for GST refunds, the procedure for obtaining it, and tips for a smooth refund process.

Contents

- What is FIRC?

- Importance of FIRS/FIRC for GST refunds

- Proof of Inward Remittance of Foreign Currency:

- Authenticate the Payment Received:

- Mandatory Requirement:

- Verification by the GST Authorities:

- Procedure for obtaining FIRC

- GST refund process with FIRC

- Tips for a smooth GST refund process with FIRC

- Conclusion

- FAQs

What is FIRC?

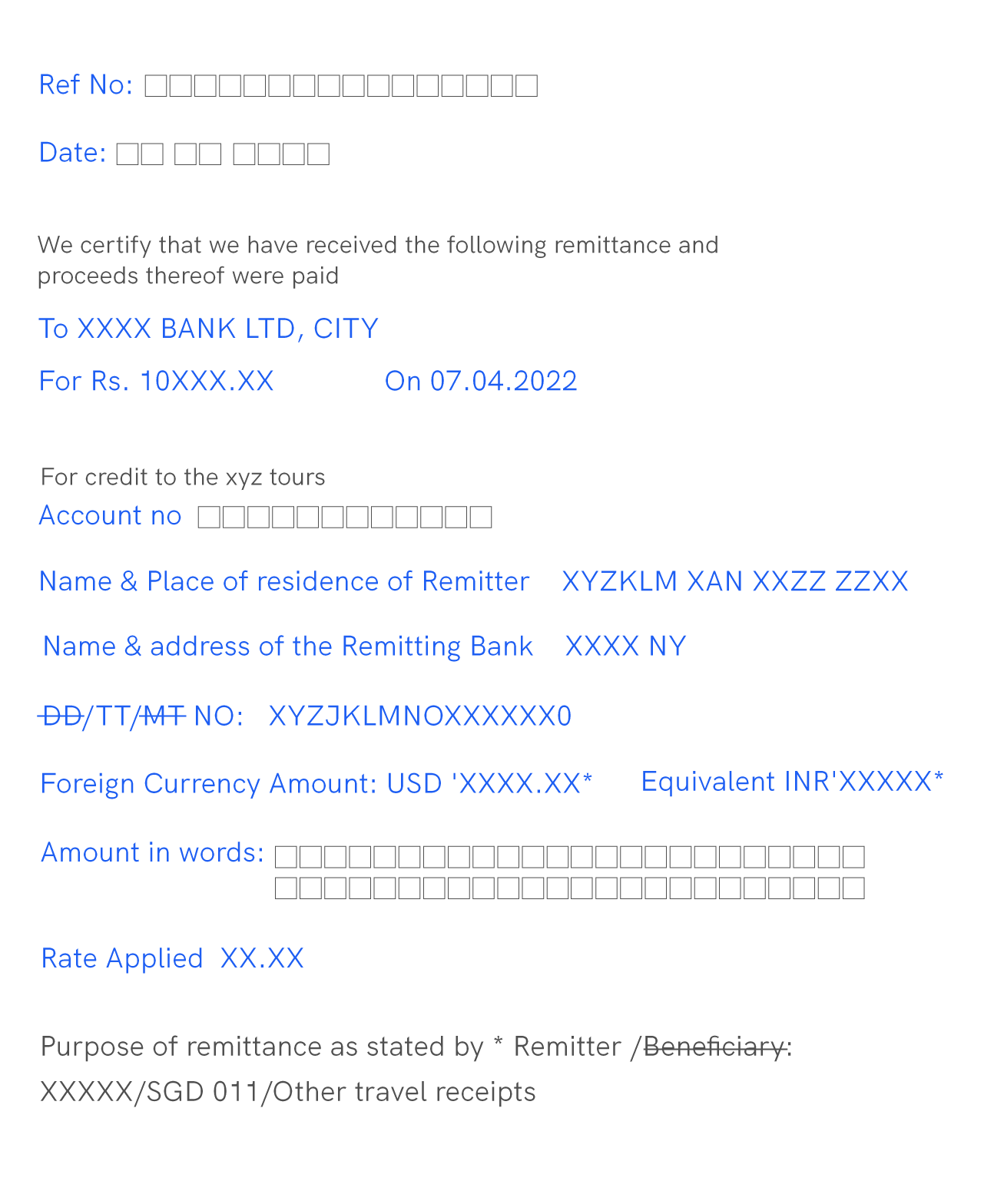

FIRC stands for Foreign Inward Remittance Certificate, which is a document issued by banks in India to individuals or companies who receive money from abroad. As mentioned above, this certificate serves as proof of inward remittances of foreign currency.

It includes details such as the beneficiary's name and address, the inward remittance amount and currency, and the transaction date. FIRC is a crucial document for several purposes, including claiming GST refunds, as it helps to authenticate the payment received from an overseas party.

Importance of FIRS/FIRC for GST refunds

FIRC (Foreign Inward Remittance Certificate) is critical if you’re looking at claiming GST refunds in India. Here are the reasons why FIRC is important for GST refunds:

Proof of Inward Remittance of Foreign Currency:

FIRC serves as evidence of the inward remittance of foreign currency to an individual or a company in India. This proof is required to claim a GST refund for any goods or services exported from India.

Authenticate the Payment Received:

FIRC helps to authenticate the payment received from an overseas party. It ensures that the GST refund being claimed is genuine and not fraudulent.

Mandatory Requirement:

FIRC is mandatory for claiming GST refunds for exports of goods or services. Without FIRC, the claim for a GST refund may not be accepted.

Verification by the GST Authorities:

The GST authorities verify FIRC to ensure that the GST refund being claimed is genuine and that the refund amount claimed is correct.

Procedure for obtaining FIRC

Here is the procedure for obtaining FIRC (Foreign Inward Remittance Certificate) in India:

Provide Details to the Bank:

Provide the necessary details regarding the inward remittance to your bank, including the purpose of the transaction, the amount, and the name and address of the remitting party.

Submit Supporting Documents:

Submit any supporting documents, such as invoices, purchase orders, or contracts related to the inward remittance, to the bank.

Await Remittance:

Await said inward remittance of the foreign currency in the bank account.

Request for FIRC:

Request the bank to issue a FIRC. The bank will verify the details and issue it.

Collect FIRC:

Collect FIRC from the bank. The FIRC will include details such as the name and address of the beneficiary, the amount and currency of the inward remittance, and the transaction date.

Keep FIRC Safe:

Keep the FIRC safe as required for various purposes, including claiming GST refunds.

Payment for each FIRC:

Bank deducts these payments from the bank account.

Get Free FIRC for international transactions with SALT

Salt provides free FIRC for every international transaction completed on our platform. Our users can download FIRC on the dashboard by simply logging into their Salt account.

GST refund process with FIRC

Here is the GST refund process with FIRC (Foreign Inward Remittance Certificate):

Eligibility for GST Refunds with FIRC: To be eligible for GST refunds with FIRC, the goods or services must have been exported outside of India, and the payment received as inward remittance must be in foreign currency.

Supporting Documents Required for GST Refund Application with FIRC: Supporting documents required for GST refund application with FIRC include the invoice issued for the export of goods or services, proof of inward remittances of foreign currency through FIRC, and a copy of the shipping bill filed with the customs authorities.

Filing GST Refund Application with FIRC: To claim a GST refund with FIRC, file the GST refund application along with the supporting documents on the GST portal. Ensure that the details in the application and supporting documents match those in FIRC.

Verification by GST Authorities: The GST authorities will verify the FIRC and supporting documents submitted along with the GST refund application. They will ensure that the GST refund being claimed is genuine and that the refund amount is correct.

GST Refund Processed: Once the GST authorities verify the FIRC and supporting documents, they will process the refund. The refund amount will be credited to the bank account linked to the GST registration.

Tips for a smooth GST refund process with FIRC

Here are some tips for a smooth GST refund process with FIRC (Foreign Inward Remittance Certificate):

Ensure Accuracy of FIRC Details: Ensure that the details in FIRC, such as the name and address of the beneficiary, the amount and currency of the inward remittances, and the date of the transaction, are accurate and match with those in the supporting documents and the GST refund application.

Submit Supporting Documents with the Correct Details: Submit supporting documents, such as invoices, purchase orders, or contracts related to the transaction, with the correct details, including the GSTIN, invoice number, and date.

Verify Eligibility Criteria: Ensure that the goods or services exported outside India are eligible for GST refunds and that the payment received is in foreign currency.

File GST Refund Application on Time: File the GST refund application on time within the prescribed timeline to avoid delays in processing.

Keep Track of GST Refund Application Status: Keep track of the status of the GST refund application on the GST portal to ensure that the application is being processed and there are no issues.

Contact GST Authorities if Required: In case of any queries or issues, contact the GST authorities for assistance and clarification.

FAQs

What is FIRC?

Banks in India issue a document called Foreign Inward Remittance Certificate (FIRC) to individuals or companies who receive money from abroad. This certificate acts as evidence of the foreign currency that has been received. It contains information such as the recipient's name and address, the amount and currency of the inward remittance, and the date of the transaction.

Is FIRC required for GST refund?

Yes, a Foreign Inward Remittance Certificate (FIRC) is one of the documents that may be required for claiming a Goods and Services Tax (GST) refund in India. Specifically, if a taxpayer has received payment in foreign currency for exports or supplies, they may need to provide a copy of the FIRC along with other documents to claim a GST refund. The FIRC serves as evidence of the inward remittance received in foreign currency from outside India.

Conclusion

In conclusion, FIRC (Foreign Inward Remittance Certificate) is essential for claiming GST refunds for exports where the payment received as inward remittance is in foreign currency. It is necessary to ensure the accuracy of FIRC details, submit supporting documents with the correct details, verify eligibility criteria, file the GST refund application on time, keep track of the application status, and contact GST authorities if required for a smooth and hassle-free GST refund process with FIRC. By following these tips, businesses can ensure that their GST refunds are processed efficiently and within the prescribed timeline.

Are you operating a business in India, and looking for an easy global banking solution? SALT Fintech aims to simplify global banking for small businesses like you, enabling you to easily manage your finances through local accounts. We aim to provide a hassle-free banking experience that saves you time and effort. Visit the Salt Fintech website today to discover more about our services, and find out how we can help you to achieve your financial objectives!