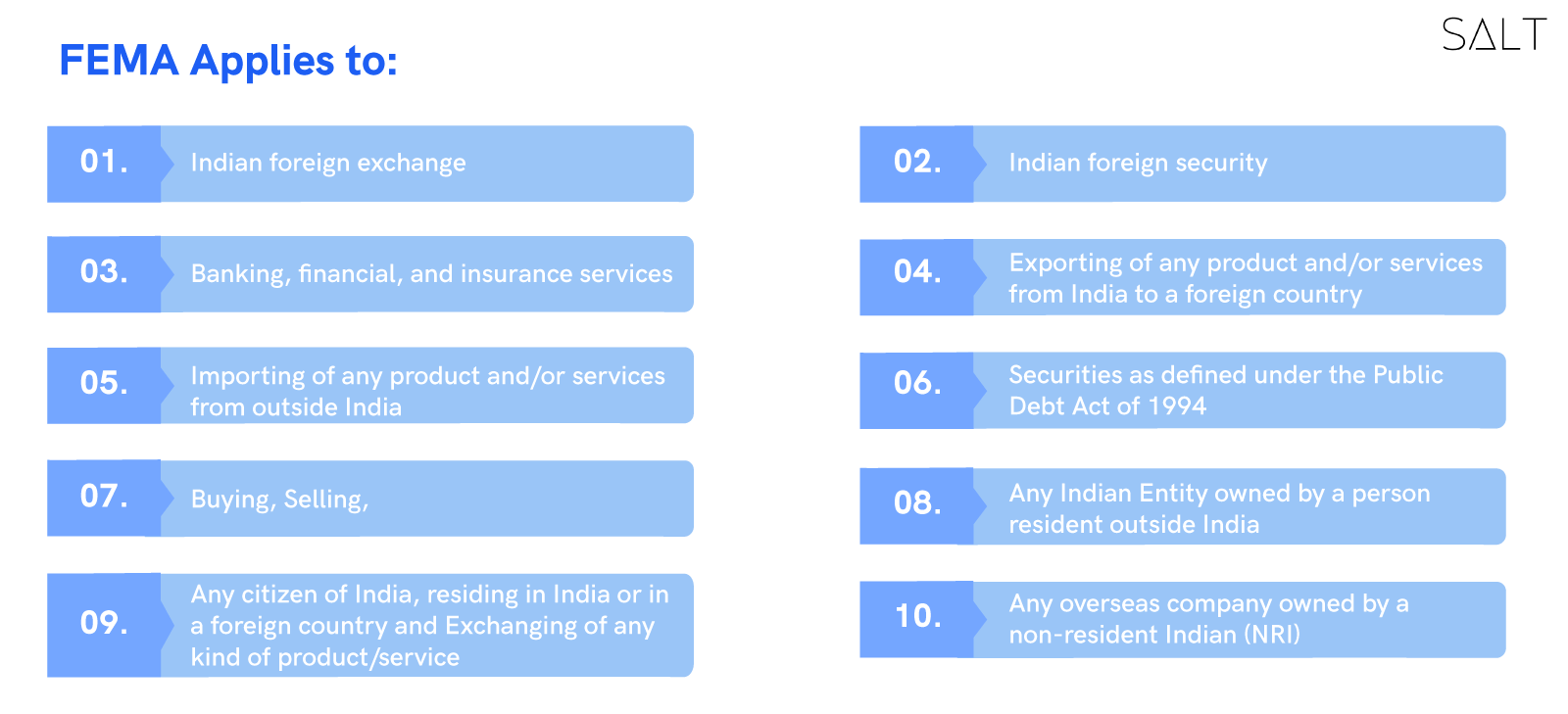

Every country has its own rules and regulations to control the financial markets and foreign remittances. FEMA, or Foreign Exchange Management Act, 1999 under the Reserve Bank, lays out the guidelines and compliance for inward remittances in the case of India. FEMA regulates the huge influx of funds for startups, SMEs, and individuals to keep their international transactions legitimate and legal.

After the pandemic, there has been a shift in the global markets, adjusting the focus to Indian tech startups. A massive number of international companies have turned their heads to India for investments in startups and SMEs. And truly, In 2021, India received a whopping inward remittance of USD 87 billion, 20% of which was from the investors of the United States, according to the World Bank.

What is an Inward Remittance?

Inward remittance is the transfer of funds from an international bank to a domestic bank. When a resident of India receives money in their bank account from a relative from abroad or a startup receives funding from angel investors outside of India into its domestic bank account or a business receives payment from its' international clients, it's called an inward remittance.

Inward remittance can also be in the form of employee compensation. The flow of capital and funds via Inward remittances provide a cushion to the financial economy of any country by enhancing the country's purchasing power and consumption and adding to the gross domestic product.

Legal formalities for Inward Remittances

Whether you are an NRI sending money to a family member or a startup or a SME procuring funds or payments from a foreign partner or a client, or vice versa, FEMA guidelines govern whatever transaction you undertake.

In the case of remittance - inward or outward, two parties are directly involved in the transaction:

1. The Remitter

The Remitter is an investor, a client for the domestic venture, or any individual interested in sending remittances back home. The remitter transfers the money to the domestic bank. In order to do so, the remitter must submit these basic details to the bank to get the approval of the bank:

Remitter's name and address

Bank branch details

Nationality of the bank

Bank account number, and

Bank swift code

2. The Remittee

The Remittee on the other hand, must provide information to its bank concerning:

The contract of the transaction

Information of remittance that includes the remitter's credentials and amount in foreign currency

Invoice, and

The purpose of the transaction

The Remittee must get the Foreign Inward Remittance Certificate (FIRC) as proof of ‘transfer of funds from overseas to India.’ This certificate acts as an endorsement to the receiver acquiring the payment. The approval of this certificate is essential for obtaining the foreign payment.

The remitter and remittee must fulfil the fee obligations to facilitate overseas transactions.

The concerned bank charges a small fee in exchange for its services. The fee varies from bank to bank, and if the remitter uses the SWIFT system to make a remittance, the banks aren’t able to specify exactly the fees to be deducted from the remittance. Banks also add a markup to the actual exchange rate called currency spread, cutting pennies on every dollar you earn.

You can override the formalities and roadblocks in traditional banking remittances by opting for SALT, a neo-banking solution serving all your banking needs in a hassle-free and borderless way.

SALT’s multi-account, multi-currency global banking solutions help you transact business and receive remittances at the lowest FX rate and fees, within 24 hours!

Guidelines by FEMA

A remitter can send remittances to India via traditional methods like bank draft or telegraphic transfers. RBI lets the remitter send inward remittances to the remits residing in India via two routes; namely:

Money Transfer Service Scheme (MTSS): MTSS transfers are facilitated by reputable foreign money transfer services that work with authorised agents in India. MTSS transfers concern personal transfers and not for trade or charity donations.

Approval for inward remittance is only granted if the documents required (already discussed under legal formalities) from both the parties (the remitter and the remittee) have been accurately filed and submitted.

The remittee needs to acquire the FIRC certificate under any circumstance.

While perusing the RDA route to send inward remittances:

- There is no maximum limit on the amount of money that can be sent via personal transfers

- The RBI restricts the amount of money that is sent under business transfers via the RDA route

When MTSS is the tool for sending inward remittance to India:

- There is a ceiling of $2,500, beyond which transfers cannot be made

- The number of transactions is capped at 30 transfers a year to a single remittee, as specified by FEMA

Inward remittance via RDA or MTSS payments must be made by authorised agents in India.

An inward remittance, by definition permissible by the RBI, should be transacted for the following reasons:

- Education purposes

- Medical treatment

- Travel expense payments

- Investor funding via remittances

- Businesses receiving payments from foreign clients

- Personal transactions in the form of gifts or living expenses.

Remittance of lottery winnings, winnings from races or riding, earnings from banned magazines, sweepstakes, and other such transactions that the central bank has prohibited are strictly forbidden by FEMA and RBI.

Under the FEMA, the Liberalised Remittance Scheme (LRS) lays down certain policies that make inward remittance transfers more accessible:

i) Under LRS, all individuals, even minors, can make transactions of up to $250,000 in a fiscal year.

ii) Inward remittance under LRS with its maximum limit can be carried out through a current account, a capital account, or both.

With the emergence of startups and the development of SMEs, the Indian economy requires huge investments to fund these ventures. Inward remittance is a less costly method of external financing than equity or debt obligations. These are made easier via online and offline routes. If you are a raising startup or a developing small or medium sized enterprise, avail of Salt’s cross-border payments and compliance solutions to receive inward remittance in India without any complications.