The Union Budget of India is a critical document - after all, it announces the budgetary allocations to different ministries of the government, broad policy positions, and other key financial decisions in a particular fiscal year. The Finance Minister of India, Nirmala Sitharaman, tabled the Union Budget 2024 on February 1 as an interim budget - since there are parliamentary elections scheduled for the year.

The Indian economy has accelerated as official estimates pegged its growth at 7.6% in the second quarter of the current financial year. Startups in India have played a significant role behind this growth, which the government has recognised with programs like Startup India.

Our blog simplifies all tax benefits announced in the Union Budget 2024, which can incentivise your startup!

Major takeaways from the Union Budget 2024

Before we jump into the critical startup incentives announced in the Union Budget 2024, let's look into some other prime decisions announced in the Budget:

No change in taxation:

The Union Budget 2024 stated there would be no direct and indirect tax rate changes in the financial year 2024-2025. At the same, the Union government has proposed to withdraw any old tax demand notices to taxpayers amounting to INR 25,000 till the financial year 2009-2010 and INR 10,000 for the financial years between 2009-2010 and 2014-2015.

Capital expenditure:

The government would continue to increase the outlay for capital expenditure in the country. For the next financial year, it has increased the allocation by 11% to more than 11 lakh crore, which accounts for 3.4% of the Indian economy's GDP

Fiscal deficit:

The revised fiscal deficit for 2023-2024 was at 5.8%, according to the Union Budget 2024. For the next financial year, the government has set a target of 5.1% and will eventually reduce it below 4.5% in the subsequent financial years.

Viksit Bharat:

The Union Budget 2024 aims to set the foundation for a 'Viksit Bharat' by 2047. The government claimed in the Union Budget 2024 that it would announce a detailed roadmap for a developed India in the full Budget in July 2024.

Four sections for government support:

The government highlighted four sections of society that would receive its primary focus, with several schemes created for them. It includes the poor, women, farmers, and the youth.

Tax benefits for startups in India

Various startup incentives related to taxation were announced in the Union Budget 2024:

Tax Holiday extended:

Startups in India incorporated until March 31 2024, and with turnovers below INR 100 crore can enjoy a tax holiday for a block of three years in the first ten years of their incorporation. This deadline was extended till March 31 2025, enabling startups to have one more year to derive the tax benefits.

GIFT City units:

Pension and sovereign wealth funds investing in startups in India currently enjoy tax benefits from their profits, dividends, and interest from their GIFT City units. Until now, the investments between April 2020 and March 2024 were eligible for tax breaks, but the exemption has been extended till March 2025 as well. It will likely facilitate further investments into the startup sector through GIFT City.

Apart from the above initiatives, startups in India also have the following incentives:

They can carry forward their losses within the first ten years of incorporation and reduce taxable incomes.

They can claim an exemption if they invest their long-term capital gains in government-specified funds, according to section 54EE.

Government recognition for startups in India

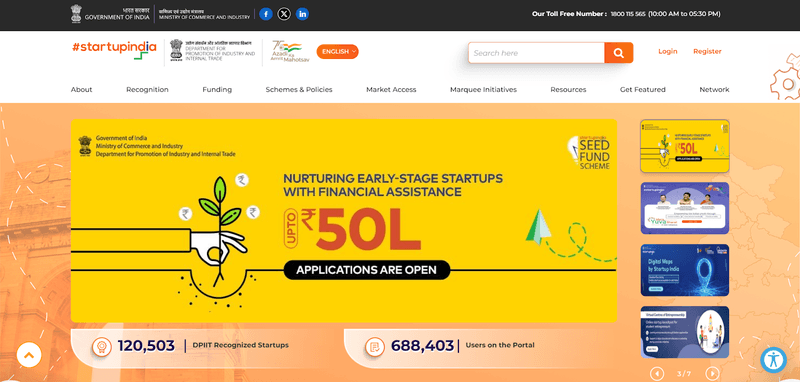

Source | The Startup India program

Since the launch of Startup India in 2016, there has been a steady rise in the number of startups in India. According to official data, startups in India have directly created over 1.2 million jobs, while there is at least one recognised startup in every state and Union territory in India. The data states over 80% of districts have startups, which creates crucial economic significance for the country.

Meanwhile, the Union Budget 2024, while recognising the importance of startups, also promoted two startup incentive programs:

A 1 lakh crore corpus has been created to provide interest-free loans to the ‘tech savvy’ youth of the country for fifty years. The corpus will mainly target to boost private investment in sunrise technologies. Startups in these sectors could benefit to a huge extent from these interest-free loans.

The Startup India Seed Fund, which funds startups in India with seed money at their early stages, got an allocation of INR 175 crores in the Union Budget 2024.

Sort out your financial woes with SALT Fintech

Salt Fintech make cross-border payments as easy as they can get! Our product ‘Table by SALT’ enables startup founders to get funds from foreign investors seamlessly, along with automating regulatory filings. Visit our website and handle your startup’s international finances with low fees, no hidden charges, and smooth transactions!

Further, explore our blog as your one-stop solution for all information related to the financial services industry!

FAQS

Are there any startup incentives in taxes in the Union Budget 2024?

Yes, two major announcements in the Union Budget 2024 extended the tax holiday for startups till 2025, as well as providing a year more to pension and sovereign funds to smoothly invest in startups in India with tax breaks

2. Does the government recognise Indian startups?

Yes, startups in India are officially recognised by the DPIIT ministry of the Government of India, which also runs a slew of schemes for them.