Many believe sending and receiving funds internationally through their banks is the safest and most reliable option. You can make international payments to banks in India and elsewhere because they have extensive global networks.

The time it takes to receive funds can be reduced from days to hours with the assistance of money transfer experts and other digital monetary services. We'll walk you through the necessary bank information and other details here.

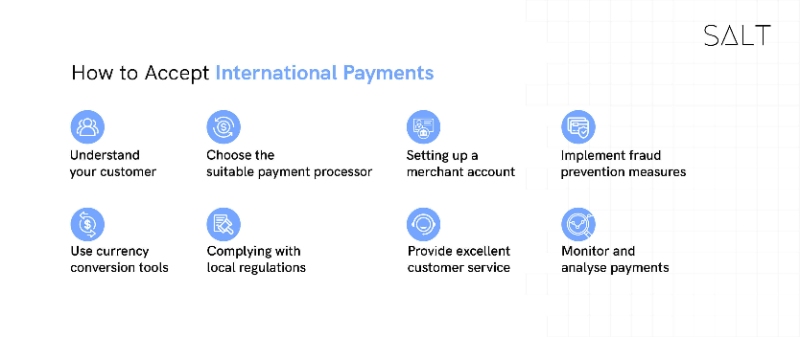

How to Accept International Payments?

To accept cross-border payments, one must go through these steps:

Understand your customer:

Before accepting international payments, it is essential to understand the needs and preferences of your customers. This includes their preferred payment methods, currency, and applicable local regulations.

Choose the suitable payment processor:

Many different payment processors can accept international payments. Some popular options include PayPal, Paytm, Stripe, and Square. Each of these processors has different fees and requirements, so it is essential to research and choose the best for your business.

Setting up a merchant account:

You must set up a merchant account with your chosen payment processor. This typically involves providing basic information about your business, such as company name and contact details.

Implement fraud prevention measures:

International payments are more vulnerable to fraud than domestic payments, so it is essential to implement measures to protect your business. This includes using fraud detection software, setting up fraud alerts, and verifying the identity of your customers.

Use currency conversion tools:

Many customers will be paying in different currencies, so you need to use currency conversion tools to ensure you receive the correct amount. This can be done through your payment processor or a separate currency conversion service. You can check out salt's currency converter.

Complying with local regulations:

Each country has different regulations regarding international payments, so it is important to comply with them to avoid legal issues. This includes obtaining necessary licences or permits and adhering to data protection laws.

Provide excellent customer service:

Providing excellent customer service is crucial when accepting international payments. This includes responding quickly to customer inquiries, handling disputes fairly, and providing accurate and detailed invoices. We at Salt, provide 24 Hrs customer support and a dedicated relationship manager to manage your business transaction queries.

Monitor and analyse payments:

Regularly monitoring and analysing your international payments will help you identify any issues and make adjustments as needed. This includes tracking your payment processing fees, monitoring conversion rates, and analysing customer data to identify patterns and trends.

Bank Details Required to Accept International Payments

When accepting international payments, you will typically need to provide the following bank details to your payment processor:

Business name and address:

The business name and address are required to verify the merchant's identity and ensure that payments are sent to the correct account.

Tax ID number:

It is required for tax purposes and to comply with local regulations.

Bank account details:

The bank account details are required to ensure that the payments are deposited into the correct account. This includes the bank name, account number, and routing number.

SWIFT code:

The SWIFT code is an international bank code required to process international payments. It is a unique code that identifies the bank and branch where the account is held.

IBAN number:

The IBAN (International Bank Account Number) is a unique number used to identify bank accounts in certain countries. It is typically required for payments to be made to European countries.

Beneficiary name:

The beneficiary name is the name of the person or company to whom the payment is being sent to.

Beneficiary address:

The beneficiary address is the person or company to which the payment is sent.

Business registration documents:

Some countries may require business registration documents such as the business registration certificate, business licence, or VAT registration number.

Proof of Address:

A proof of address, such as a utility bill or lease agreement, is required to verify the address of the business.

ID or passport of authorised signatory:

An ID or passport of the authorised signatory is required as proof of identity.

It's important to note that the requirements may vary depending on the country, payment processor, and bank, and it's essential to check with them before starting the process to ensure that all the necessary information is provided.

Why are these bank details important?

Bank details are required to accept cross-border payments, because they provide the necessary information for the funds to be transferred and deposited into the correct account. The receiving bank's name, routing number, and account number ensure the funds are directed to the intended recipient. Additionally, the recipient's name and address help confirm the account holder's identity and ensure that the funds go to the correct person or business.

Furthermore, providing accurate bank details also helps to reduce the risk associated with fraud and errors in the payment process. Businesses and individuals can protect themselves from potential financial losses by verifying the recipient's identity and ensuring that the funds go to the correct account.

In summary, bank details are essential for accepting payments internationally because they provide the necessary information for the funds to be transferred and deposited into the correct account. They also help reduce the risk of fraud and errors in the payment process. Overall, providing accurate bank details is crucial for ensuring that transactions are completed smoothly and securely.

Conclusion

In conclusion, a bank account with IBAN and SWIFT/BIC codes is required to accept cross-border payments. These codes identify the bank and account to which the funds will be transferred. Additionally, the merchant may need to provide documentation, such as a business registration or tax ID number, to comply with anti-money laundering regulations.

Salt is a neobank dedicated to providing you with the comfort of doing global business with local accounts. Give our website a visit today to find out more!